The COVID-19 pandemic revealed significant vulnerabilities in global supply chains— forcing businesses to rethink old strategies of offshoring production to cut costs. Over the past few years, there has been a deliberate reshoring of manufacturing to North America, reinforced by uncertainty from military conflicts and geopolitical and trade tensions across the world.

The technology revolution and new efforts to stabilize supply chains and foster innovation are creating a perfect storm for investment. This means manufacturing companies that were once at a disadvantage against low-cost offshore production are now poised to thrive on home soil.

But most Canadian companies are not in a position to take advantage of this trend. According to the Business Development Bank of Canada (BDC), in 2022, Canadian labour productivity was 28% lower than in the US and 18% lower than the G7 average. This is due to a lack of capital and technology adoption, which is where Pioneera Ventures can play a crucial role.

The Pioneera Approach

Pioneera Ventures acquires Canadian-based manufacturing companies in high-growth sectors and injects them with capital and technology. By expanding operations beyond Canada’s borders and integrating advanced tech—while keeping operations headquartered in Canada—we’re creating a portfolio of companies that grow our local economy while thriving in a global market.

- Acquire Canadian manufacturing companies in focus industries

- Scale through add-ons and new market entry

- Integrate new technology

- Grow sustainably

Our Investment Focus

We’re focused on investing in, and growing, companies in the Canadian manufacturing sector in industries that are tech-enabled and future-proof. From an investment perspective, Canadian companies have a bigger productivity gap, which presents more opportunity for growth.

Geography:

Companies headquartered in Canada.

Target Market:

North America while creating new global opportunities.

Industries:

Industrial products, building materials, agriculture & food.

Range:

$2-$5 million EBIDTA (Lower Middle Market).

Vertical:

Manufacturing in areas where Canada’s has a strategic advantage.

Pioneera’s Advantage

Unique Dual Fund Strategy

We combine private equity in manufacturing with a special opportunities fund in advanced manufacturing technology. This creates a circular economy within Pioneera Ventures. As we acquire manufacturing companies, we invest in technology firms driving their transformation.

Experienced

A diverse team not just focused on investing in companies, but transforming Canadian manufacturing for the benefit of partners, our economy, and our communities.

The Right Timing

The aging and retiring population – called the “silver tsunami” – means over 120,000 manufacturing businesses will be passed from baby boomers to new owners. This creates opportunities to acquire, modernize, and scale these companies, making them global leaders for the next industrial era.

How We Work Together

Investors

We employ a dual exit strategy, aiming for strategic sales or public offerings.

We maintain a conservative leverage approach, capped at 3x EBITDA, ensuring sustainable growth and financial stability across our investments.

Businesses

We’re open to a variety of models which include full acquisition—if the Owner/CEO is interested in selling—and partnership options if the Owner/CEO wishes to continue to manage the business but needs an injection of capital and expertise to help grow.

We take a majority stake (>51%) in the company but are flexible on the model for the remaining shares to ensure continuity and sustainability for the company and employees.

Service Providers

We’re not just looking to help build company growth. We are committed to building community.

Transforming Canadian manufacturing requires the collaboration of partners across tech, government, and industry. If you think your organization can help with our mission, reach out to schedule a conversation with our team.

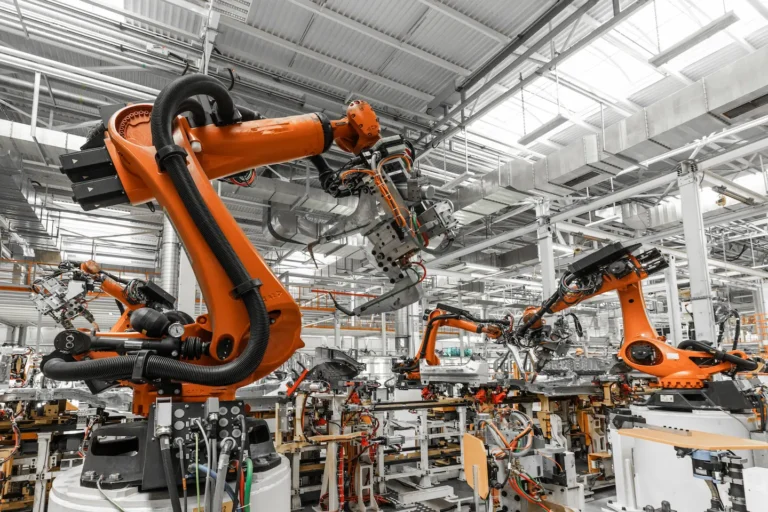

Technology Integration

We bring advanced technologies like AI, IoT, robotics, and automation to the companies we invest in, enabling them to modernize and scale efficiently.

Industry 4.0 & 5.0 Expertise

Our team has extensive experience in integrating Industry 4.0 and 5.0 principles into manufacturing, improving productivity, reducing costs, and enhancing quality.

Scalability through Add-Ons

We help our portfolio companies scale by identifying and acquiring complementary businesses, creating centralized platforms that optimize processes and market positions.

Sustainable Growth

With a focus on clean tech and renewable energy, we ensure that the businesses we invest in are aligned with the growing demand for sustainable and environmentally responsible solutions.

Insights, Innovations, and Strategies for Industry Leaders

-

Case Studies

Explore successful integrations of technology with manufacturing that have driven efficiency improvements and growth.

-

AI in Manufacturing

Insight into the implementation of AI within manufacturing processes and the efficiency gains it offers.

-

Canadian Manufacturing Efficiency Report

Research on how Canadian manufacturing compares to other G7 nations, highlighting opportunities for improvement.

-

IoT and Data Analytics

How real-time data improves decision-making and operational efficiency in manufacturing.

-

Podcast: The Future of Manufacturing

Listen to experts discuss the future of manufacturing technologies and how AI and automation will continue shaping the industry.

-

Predictive Maintenance and AI

Explore how predictive maintenance driven by AI is reducing machine downtime and improving operational efficiency.

-

Robotics & Automation

Showcasing the impact of robotics and automation on modern manufacturing.